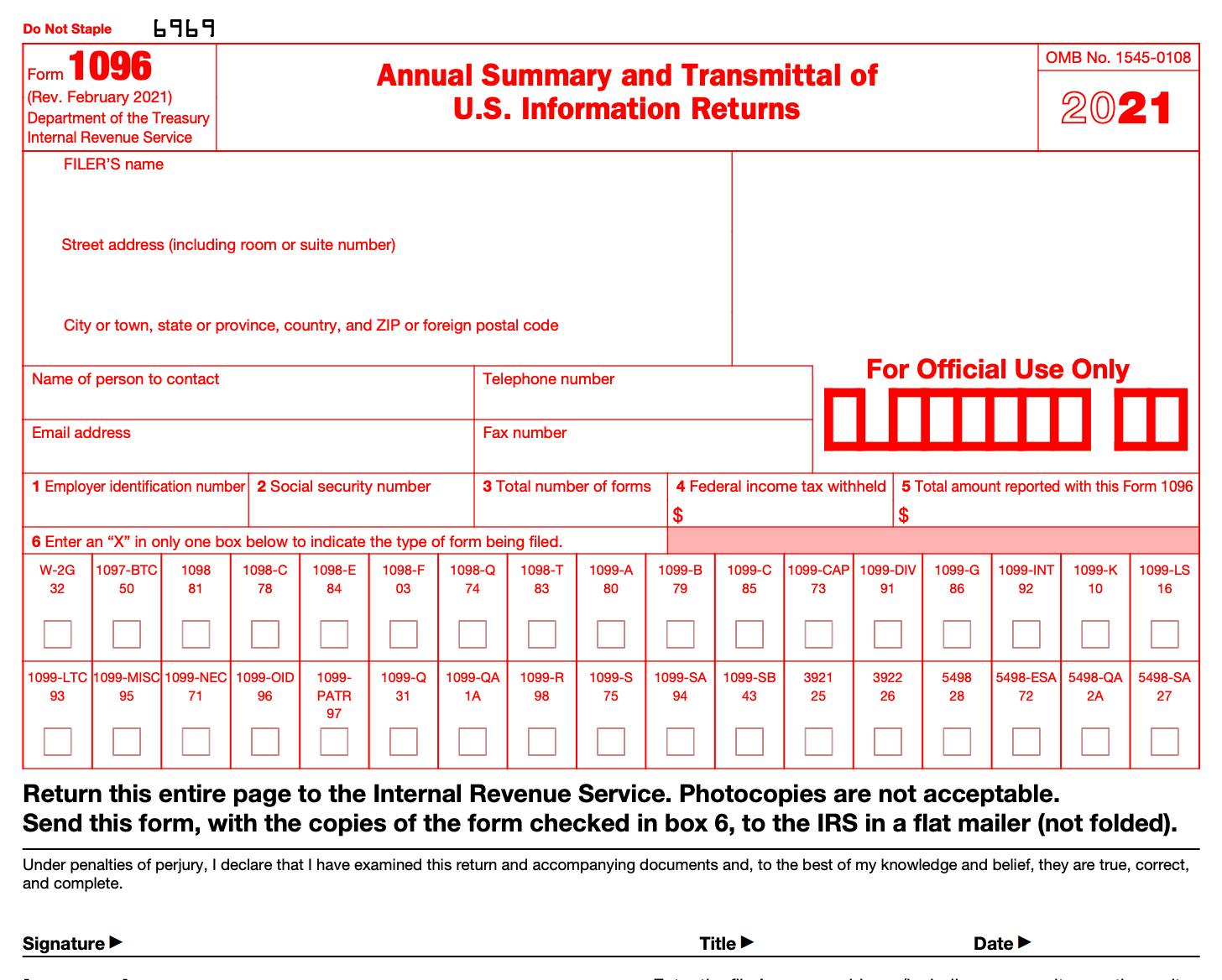

Well, 1099 taxes for independent contractors have gotten a bit more complicated in That's because the IRS has implemented a new Form 1099NEC for businesses to report their nonemployee compensation (NEC) payments to service providers, but the IRS continues to use a revised Form 1099MISC for most other paymentsIt's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarter If you pay too little in estimated taxes the IRS may subject you toFor that year, you need to File a 1099 MISC Tax Form for your recipient who takes payment from you for their service An

Form 1099 Misc It S Your Yale

Independent contractor 1099 form 2020

Independent contractor 1099 form 2020-Independent contractors (also known as 1099 contractors) use Schedule C to report business income If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, and profits or losses If you operate a business in the Sharing Economy or if you work as an independentA list of job recommendations for the search 1099 form independent contractor is provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggested

Change To 1099 Form For Reporting Non Employee Compensation Ds B

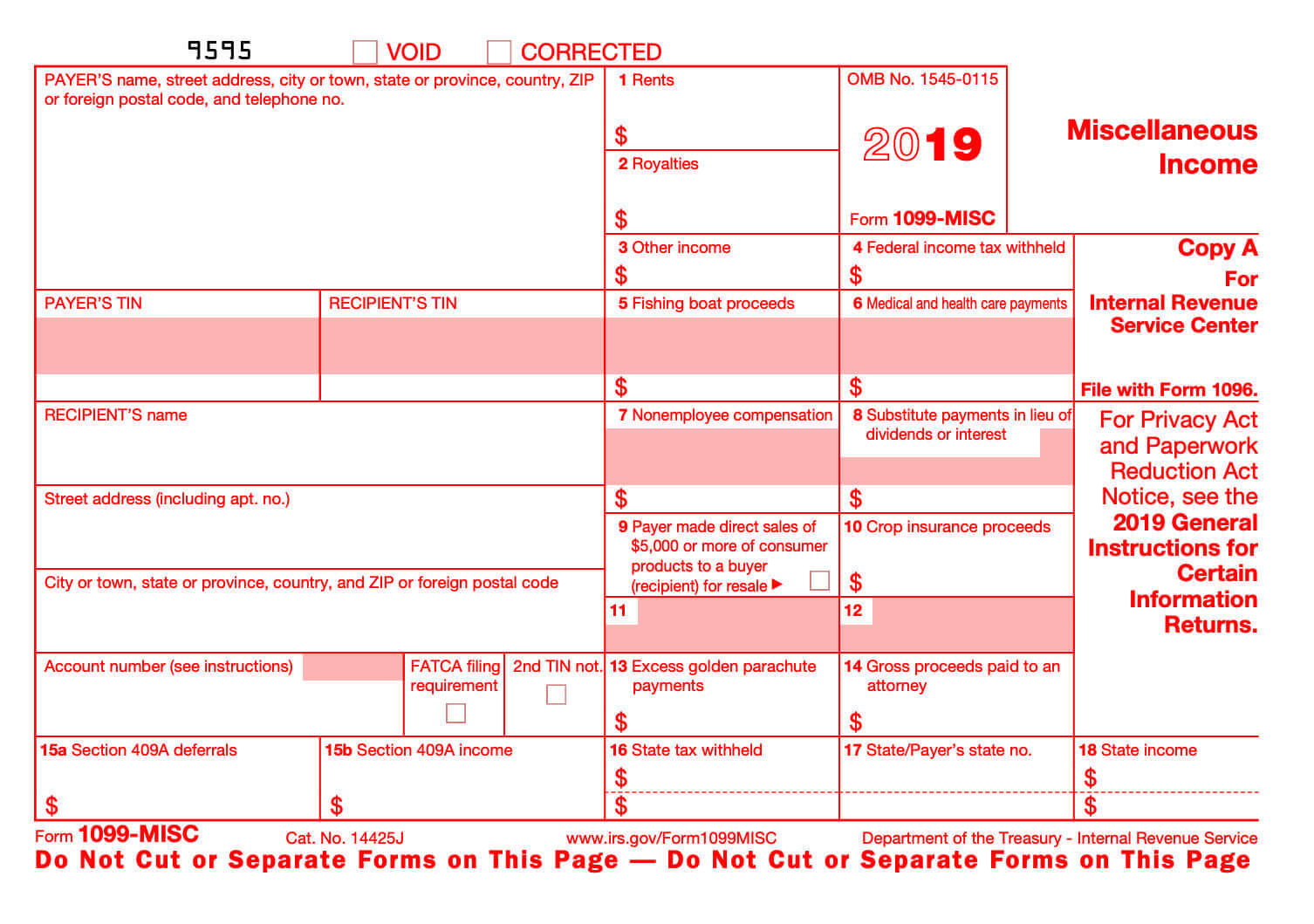

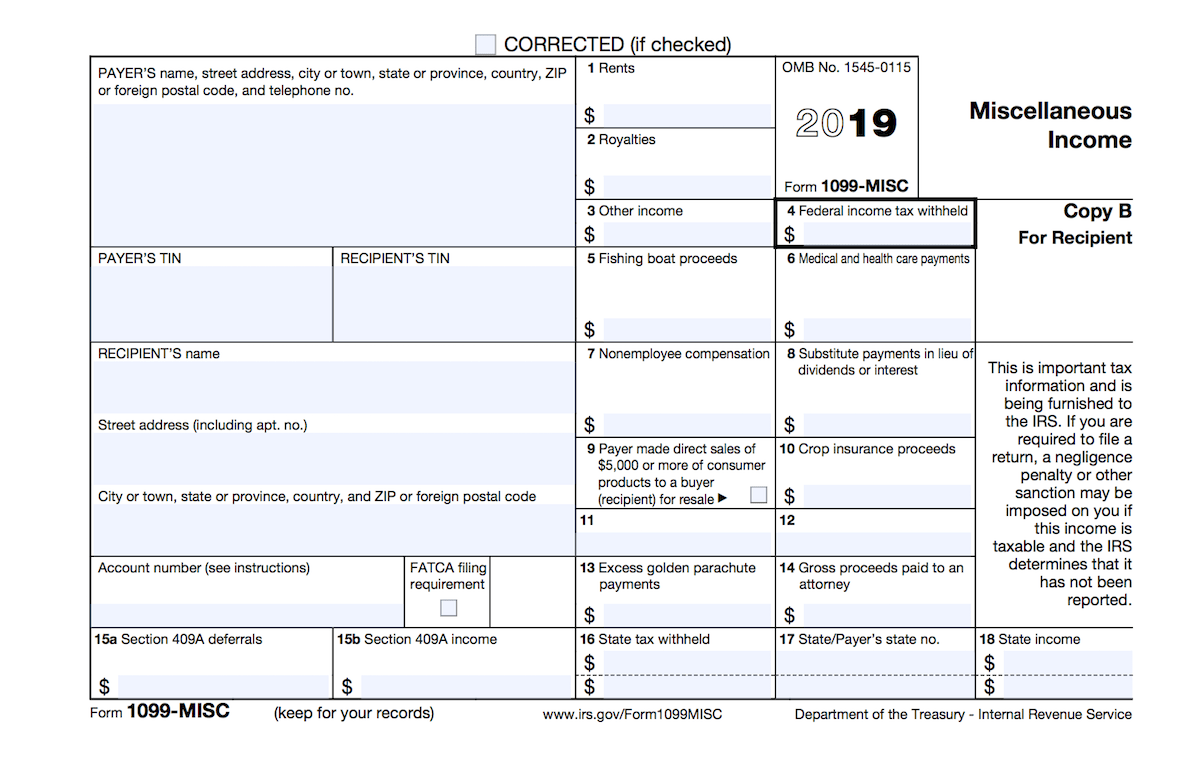

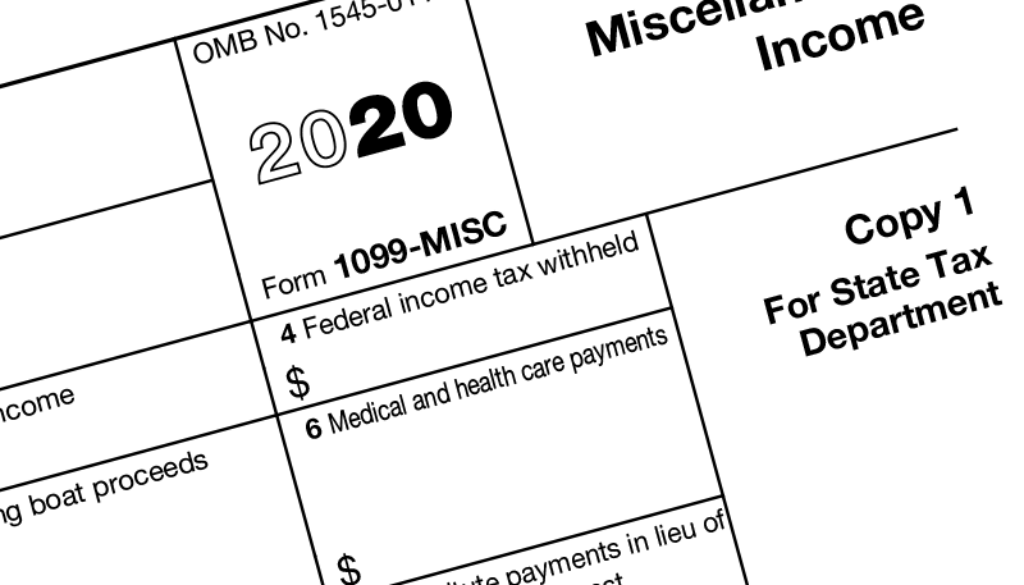

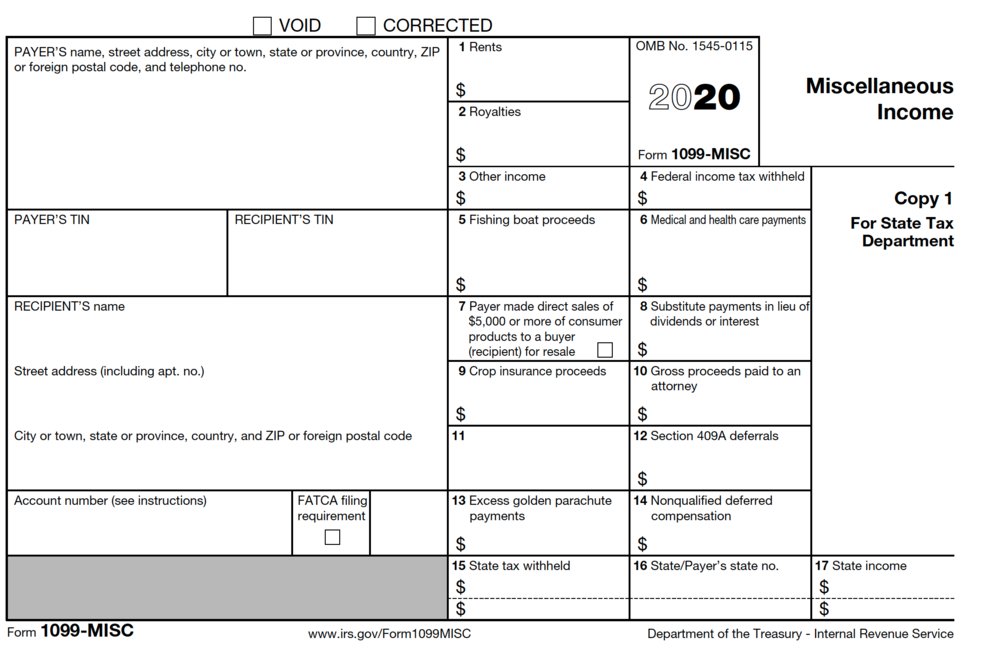

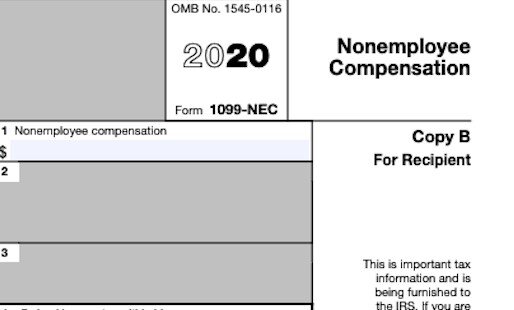

The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)You require them to obtain a dba in order to work for you UnderAn official website of the united states government the determination can be complex and depends on the facts and

Independent Contractors Guide to 1099 MISC Forms Did you receive a 1099 MISC Form in the mail?Prior to the changes that gave way to the 1099 form independent contractor , the Form 1099MISC was the more familiar form This form was used to report royalties, nonemployment compensation, and other types of income The Form 1099MISC was also used when businesses needed to report any direct sales of at least $5,000 of consumer products to a buyer for resale For the 1099 MISC Form Filing process, go through our lines 1099 MISC Form for an Independent Contractor to whom you paid $600 or more amount START 1099 MISC When you paid more than or equal to 600$ to the non–employee during the year?

Box 1 of Form 1099‐NEC for the tax year will be used instead of Box 7 on the 1099‐MISC for payments of $600 or more in nonemployee compensation This box will include payments to independent contractors, attorneys, and golden parachute payments While attorneys' fees over $600 should be reported on Form 1099‐NEC in Box 1, gross Independent Contractor and Statutory Employee You might be both an independent contractor and employee at the same time As a statutory employee, you will receive periodic paychecks and, for each tax year, a W2 from your employer(s) by January 31 of the following year If you also have independent contract income, that might be reported via one or 1099NEC is the version of Form 1099 you use to tell the Internal Revenue Service whenever you've paid an independent contractor (or other selfemployed person) $600 or more in compensation (That's $600 or more over the course of the entire year) The IRS uses this information to independently verify your income, and therefore your federal income tax levels

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Tax form 1099 is generally used to report payments to nonemployees, such as independent contractors and freelancers It may also be used to show other kinds of payments, such as rental income or standby charges for a VOD payment Printable form 1099 blank should not be used to report wages paid to employees Federal form 1099 is used in cases when there is littleWhether you're a freelancer, 1099 contractor, small business owner, or any other type of selfemployed worker, your independent contractor taxes are going to be a bit more complicated (and maybe even scary!) than you might expect Unlike for salaried jobs, with your filing status, taxes aren't automatically withheld from your selfemployment income pay stubs throughout the year 1099 Independent Contractor vs Employee Updated Which is why I created this overview of 1099 independent contractors vs employees, updated for Avoiding Taxes by Paying in Cash There are many ways small business owners pay employees under the table The most popular method is obviously cash The person does the work and the

An Employer S Guide To Filing Form 1099 Nec The Blueprint

New Form 1099 Reporting Requirements For Atkg Llp

In addition to the IRS forms that an independent contractor must file, their clients and employers are required to submit information regarding their transactions as well Any individuals or entities who have paid the independent contractor more than six hundred dollars ($600) within a tax year are required to file Form 1099 which details the transaction, as well as both individualsThey waive any rights as an employee;Printable 1099 Form Independent Contractor liaboehm Templates No Comments 21 posts related to Printable 1099 Form Independent Contractor Irs Form 1099 Independent Contractor Tax Form 1099 Independent Contractor 1099 Form Independent Contractor Agreement Independent Contractor Form 1099 Misc 1099 Form 15

Form 1099 Misc It S Your Yale

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Get Great Deals at Amazon Here http//amznto/2FLu8NwIRS Order Forms https//bitly/2kkMEkkHow to fill out 1099MISC Form Contract Work Nonemployee CompensPayer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations, The primary tax form received by an independent contractor is Form 1099MISC If you performed work for a person or business as an independent contractor, you will receive this form at the same time that employees receive W2 forms They usually arrive around the end of January following the tax year

How To File 1099 Misc For Independent Contractor

Form 1099 Misc It S Your Yale

1099MISC Form Starting with the tax year of , a 1099MISC Form is meant to be filed for every person (ie nonemployee) you have paid over $600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099MISC form is featured below A 1099NEC Form is now the appropriate form toIf you worked as an independent contractor or received any other payment that needs to be reported on a 1099, then you should reach out to the person or business that paid you The payer should send you a copy of your 1099 by January 31st Keep in mind that if your total payments for the prior year are under $600, the IRS threshold, they may not need to send you a 1099Independent Contractor 1099 MISC Form – In general, any business that has paid at least $600 to some individual or any unincorporated organization which has obtained at least two payment amounts from that person or business should problem a 1099 Form to every person or business that has received a minimum of one of these payment quantities This form is utilized by the IRS

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

What Are Irs 1099 Forms

We'll let you know about Form 1099 types of independent contractors We have provided you the detailed information about different types of independent contractors who receive a 1099 Form in the tax year Get Start For Free When do you consider an individual as 1099 contractor? Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them toIrs 1099 Forms For Independent Contractors antoneruecker Templates No Comments 21 posts related to Irs 1099 Forms For Independent Contractors Free 1099 Forms For Independent Contractors Printable 1099 Forms For Independent Contractors 1099 Form For Independent Contractors 1099 Form For Independent Contractors 18 Sending 1099

1099 Form Fileunemployment Org

Form 1099 Nec Instructions And Tax Reporting Guide

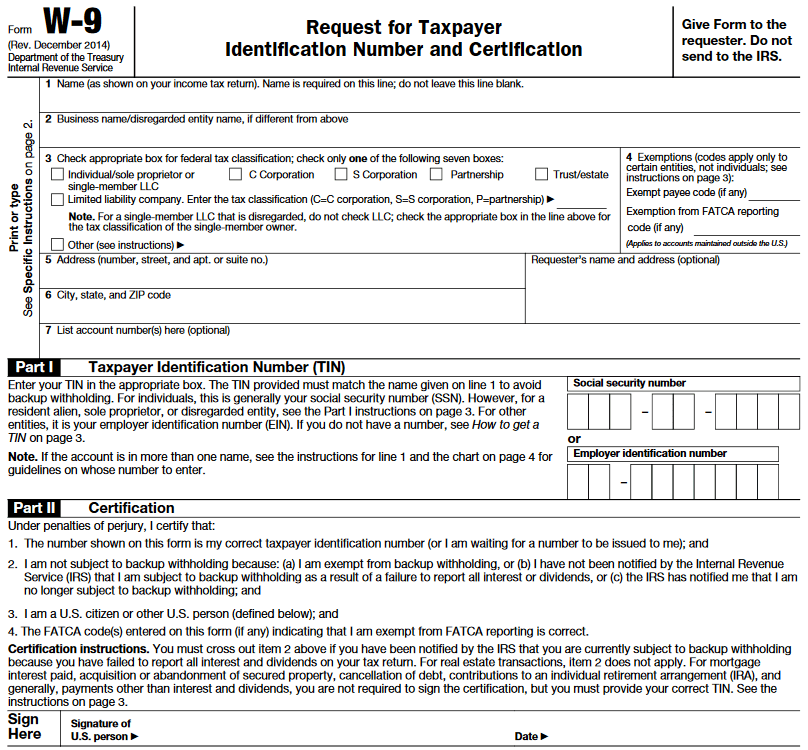

Generally, if you're an independent contractor you're considered selfemployed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) Most selfemployed individuals will need to pay selfemployment tax (comprised of social security and Medicare taxes) if their income (net earningsIf you work as an independent contractor or are selfemployed it is important to stay up to date on the latest tax changes As we start gearing up for tax season, you may be wondering what has changed for tax year 19 (filed in ) With the passage of the Tax Cuts and Jobs Act, a lot of tax changes were implemented last year, like an increase in the standard deduction and an A To file the Form 1099MISC, you'll need a Form W9 and a Tax Identification Number (TIN) for each independent contractor The contractor provides you the Form W9 You should have every contractor fill out this document before services are provided This will ensure you have the information you need to file If you don't have a W9 for one of your service

Form 1099 Nec Is New For Here S What You Need To Know

New Irs Rules For 1099 Independent Contractors

A 1099 MISC Form Online is a tax form used for independent contractors or freelancers For More https//wwwtaxseercom/1099miscformhtml#irs #1099_misc_ For example, if you give a worker a 1099 Form rather than a W2 Form, they may still be an employee Persons who work for you may qualify as employees under the law, even if, for example You have the person sign a statement claiming to be an independent contractor;1099 For Gig Delivery Drivers As an independent contractor, you may receive a 1099K, 1099NEC, and/or 1099MISC form Whether you drive for Instacart, Doordash, Postmates, Shipt or another delivery driver service, this post is for you

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

The New 1099 Nec Irs Form For Second Shooters Independent Contractors Formerly 1099 Misc Lin Pernille

By January 31 of each year, you must provide a copy of the 1099MISC form to the income recipient – that is, to the independent contractor, partnership or other entity that you paidOnce you start, use the HELP tab for 1099MISC tips and explanations Ok, Start 1099MISC NowYou received the form for working as an independent contractor for the tax year As an independent contractor, you're responsible for filing your own tax return forms Taxes are important for independent contractors to understand As with most things independently, you'll

What Is The Account Number On A 1099 Misc Form Workful

Nonemployee Compensation Form 1099 Due Dates Wichita Cpa Firm

The 1099NEC is used by companies that hire independent contractors The hiring business will fill out and send this form in, and they should also send you a copy 1099s Are a Specialty of Ours eFile360 is the tax expert you can trust with all your 1099, 1098, and ACA efiling Are you an independent contractor looking for help filing your taxes?As independent contractors in California were getting a handle on how earning Form 1099 income could affect their employment status under Assembly Bill 5 (AB 5), the state enacted a new law to further revise the state laws governing independent contractors The new statute, Assembly Bill 2257, was enacted on , to clarify the state of the law under AB 5 and provideA 1099 contractor is a person who works independently but not for an

What You Should Know About The New 1099 Form For Palm Desert Law Group Apc

3

1099 Form Independent Contractor Pdf / Printable IRS Form 1099MISC for 15 (For Taxes To Be These can include deducting costs for your home office, vehicle expenses, advertising, continuing education, insurance pr How do i report this income?Form 1099NEC The PATH Act, PL , Div Q, sec 1, accelerated the due date for filing Form 1099 that includes nonemployee compensation (NEC) from February 28 to January 31 and eliminated the automatic 30day extension for forms that include NEC Beginning with tax year , use Form 1099NEC to report nonemployee compensationStarting with the year tax filing, businesses that pay $600 or more to an independent contractor are required to fill out a new form, the 1099NEC (Nonemployee Compensation) In previous years sending independent contractors' payment information to the IRS was accomplished by the 1099MISC

How To File 1099 Misc For Independent Contractor

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Hw Co Cpas Advisors

Printable 1099 Form Independent Contractor – One of the most significant and basic paperwork you have to have all the time is a 1099 form It's a form the IRS requires all companies to maintain It can be used by businesses as an efficient way of submitting their yearly income tax returns19 1099 Form Independent Contractor – A 1099 Form is really a form of doc that helps you determine the earnings that you simply earned from various sources It's crucial to note there are many different types of taxpayers who might be needed to finish a form of this character For example, if you function as an independent contractor for someone else, you would have toForm 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade The independent contractors need

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

3

1099 Form Employee Type H R Block

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

How To Approach Tax Season As A 1099 Employee Thepaystubs

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Independent Contractor 101 Bastian Accounting For Photographers

Ready For The 1099 Nec

Instant Form 1099 Generator Create 1099 Easily Form Pros

Your Ultimate Guide To 1099s

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Irs Form 1099 Reporting For Small Business Owners In

New 1099 Nec Form For Independent Contractors The Dancing Accountant

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

1099 Misc Form Fillable Printable Download Free Instructions

By 50 Of Americans Are Expected To Be Independent Contractors Freelancers Alexander S Blog

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Do I Need To File 1099s Deb Evans Tax Company

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

Irs Changes Reporting Of Independent Contractor Payments Uhy

1

Form W 9 Vs Form 1099

Irs Introduces New 1099 Nec Form To Report Nonemployee Compensation

Tax Changes For 1099 Independent Contractors Updated For

Irs Form 1099 Nec And 1099 Misc Rules And Exceptions

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

Fillable Form 1099 Misc For Independent Contractor Edit Sign Download In Pdf Pdfrun

How To Prepare Form 1099 Nec When You Employ Independent Contractors Quickbooks

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

Form 1099 Nec Instructions And Tax Reporting Guide

How To File 1099 Misc For Independent Contractor

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is A 1099 Form A Guide For Companies With Us Contractors Remote

How To Read Form 1099 Misc Boxes And Descriptions By Tax1099 Com Irs Approved Efile Service Provider Medium

What Is Form 1099 Nec

1099 Form Instructions How To Fill Out Irs Tax Form 1099 Guide Printable Pdf Instructions Misc 1099 Tips Help

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

What Tax Forms Do I Need For An Independent Contractor Legal Io

Form 1099 Nec Block Advisors

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

1099 Nec And 1099 Misc Changes And Requirements For Property Management

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

What Is Irs Form W 9 Turbotax Tax Tips Videos

1

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Walk Through Filing Taxes As An Independent Contractor

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 Misc Form Fillable Printable Download Free Instructions

E File Form 1099 Nec Online How To File 1099 Nec For

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Form 1099 Nec Form Pros

Who Are Independent Contractors And How Can I Get 1099s For Free

How To Fill Out 1099 Misc Form Independent Contractor Work Instructions Example Explained Youtube

Form 1099 Nec For Nonemployee Compensation H R Block

What Are Irs 1099 Forms

A 21 Guide To Taxes For Independent Contractors The Blueprint

Form 1099 Nec Vs 1099 Misc For Tax Year Blog Taxbandits

Guide To Creating A 1099 Pay Stub Check Stub Maker

1099 Misc Form Fillable Printable Download Free Instructions

What Is A 1099 Employee The Definitive Guide To 1099 Status Supermoney

What Is A 1099 Contractor With Pictures

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

New Jersey Continues Its Push To End The Misclassification Of Employees As Independent Contractors Morea Law Llc An Employment Law Boutique

Irs Launches New Form Replacing 1099 Misc For Contractors In Cpa Practice Advisor

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Where Is My 1099 Atbs

Irs Tax Form 1099 Nec What It Is And What You Need To Know To Use It Blog For Accounting Quickbooks Tips Peak Advisers Denver

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

0 件のコメント:

コメントを投稿